Happy new year!

Another year is over. It was my 8th trading year since I got back to the markets in 2017. As time goes by, it becomes harder to learn much new about the markets in theory, but experiencing all the theoretical knowledge gained over the years by putting my money at risk is an invaluable journey to understand wealth creation in the markets. I’ll share some of my thoughts and key lessons that got confirmed again in 2024.

The market consensus is a bad bet

The stock market is a highly competitive field, where people compete against each other just like in sports or business. The podiums in sports have limited spots, businesses operate for a limited market share, and money in the markets is a limited resource that is the prize for overplaying others. One of the things people seem to misunderstand is if they see a company becoming more profitable, then they expect the revenue to go into the stock price. No, the revenue goes to the company’s bank account. It’s the investors’ money that is deposited to buy the stock that goes to the market. If someone withdraws their profits out, the money is someone else’s deposit, cause money doesn’t magically reproduce itself in financial markets. Therefore, it doesn’t really matter what you think about the market when making investment decisions, but actually what you think relative to others, because the goal is to extract money from the market, aka market participants. It’s not a coincidence that if the majority thinks the market must fall because of bad macro, fundamentals or overbought technicals, then the market actually starts ripping higher; and when the majority thinks the market will keep rising after a good period, then the topping phase has often started. It’s just how money, this limited resource, flows in the market relative to the consensus.

Money flow matters the most

An investor can read macro news, analyze fundamentals of a company or draw lines on a price chart, but in the end, stocks that see the biggest money inflows will rise in price the most. The fact that institutional money moves the market, creates a goal for me as a retail trader to be in front of these inflows as early as possible, and not stay for outflows. It’s the only important thing for me to create wealth in financial markets – I need to identify the assets that see the biggest money inflows and position my capital accordingly. Everything else is just noise and entertainment.

What’s your sample size?!

I’ve started to notice how everyone is backtesting without knowing it. I don’t mean a detailed quant analysis on past price data, but all the chart crime shared on social media, folks trying to fit the FED’s past decisions to today’s market, looking at past crisis to predict the next one etc. They will all be wrong about the future. Most of the time, it’s a very small sample size to begin with, which doesn’t have any statistical significance and is pure noise. The market already knows what has happened in the past, which makes the odds of the same big events happening again very low. The market is a complex adaptive system that runs on the decisions made by market participants. The reasons for past crisis are usually not present anymore and the same outcomes can’t reappear. Such content is just noise and entertainment with someone nailing a prediction from time to time just like a broken clock is right twice a day.

The edges are influenced by people’s money

The more money starts to exploit an edge, the less effective it becomes. That’s why popular thesis eventually lose money, popular strategies lose their edge and stop working. At some point there won’t be enough capital at the other side of the trade to fund winning. For example, imagine having a single restaurant in a busy street vs everyone opening their own restaurants in the same street. You need customers who keep funding your business profit, but that’s a limited resource. Financial markets are no different.

I got off the indexes

I’m not comparing myself to a benchmark anymore cause it creates limiting beliefs. My long-term expectation used to be around 2-3x the average return of the S&P 500 index. If the index returns 8% on average, then around 20% seems a good long-term goal that I’ve managed to achieve in the last 8 years, though the index has also had above average return during this time period. I’m not going to focus on it anymore. I need to leave the averages far behind without even knowing about it. The US stock market has had a great bull run and it’s a matter of time when folks will become disappointed, so why bother with this recency bias. I need to have my portfolio uncorrelated to the index once the secular trend finally turns.

Furthermore, I’m not analyzing the S&P 500 index nor using it as a market filter anymore. I’ve come up with my own index, which is much better. The S&P 500 index is basically a list of the largest 500 stocks in the US. Nothing magical about it, I can re-create this list in a mouse click. Holding the list of stocks as an ETF has just had a wonderful decade of performance thanks to money supply and large caps becoming larger by the market cap weighted formula. I backtested a strategy that bought the 10 largest stocks by market cap and kept rotating to the top in a regular time interval to see if there was an edge. The strategy has been excellent since 2016, but was clearly underperforming before. So it’s more of a random outcome than anything statistically significant to me. I have now created my own index cause I think that once big tech starts to lose its reign, whenever in the future it happens, then SPX will become a poor guide to time the US stock market due to high concentration in a handful of stocks.

Alternative markets

I’ve been trading Bitcoin since 2017. At the beginning of last year I got involved in altcoins. Now I track and trade 60 different cryptocurrencies to hunt outliers. I apply a robust mathematical trading model to a market of liquid instruments to make money. So no stories, no predictions, just going with the flow.

I also apply these principles to a list of 20 commodities that I trade to diversify my portfolio with uncorrelated return streams. Commodities are not only uncorrelated to stocks, but metals, grains, softs and energy are uncorrelated to each other, too. The idea is to capture price momentum when supply and demand go out of balance. Commodity prices have historically often “crashed” to the upside compared to stocks that have higher downside volatility.

Volatility can be good

Rising stocks can also be volatile if price goes up long-term with some heavy sell-offs in short-term. The chart may look messy, weak hands are shaken out with their tight stop losses, and I just need to hang in there to get the outlier trend like NVDA, MSTR, PLTR to name a few examples from 2024. People shy away from volatility cause it’s hard to stomach, but I see premium and excess return in it. The trick is to be able to differentiate between upside and downside volatility, cause I don’t want to hold the latter unless I’m short.

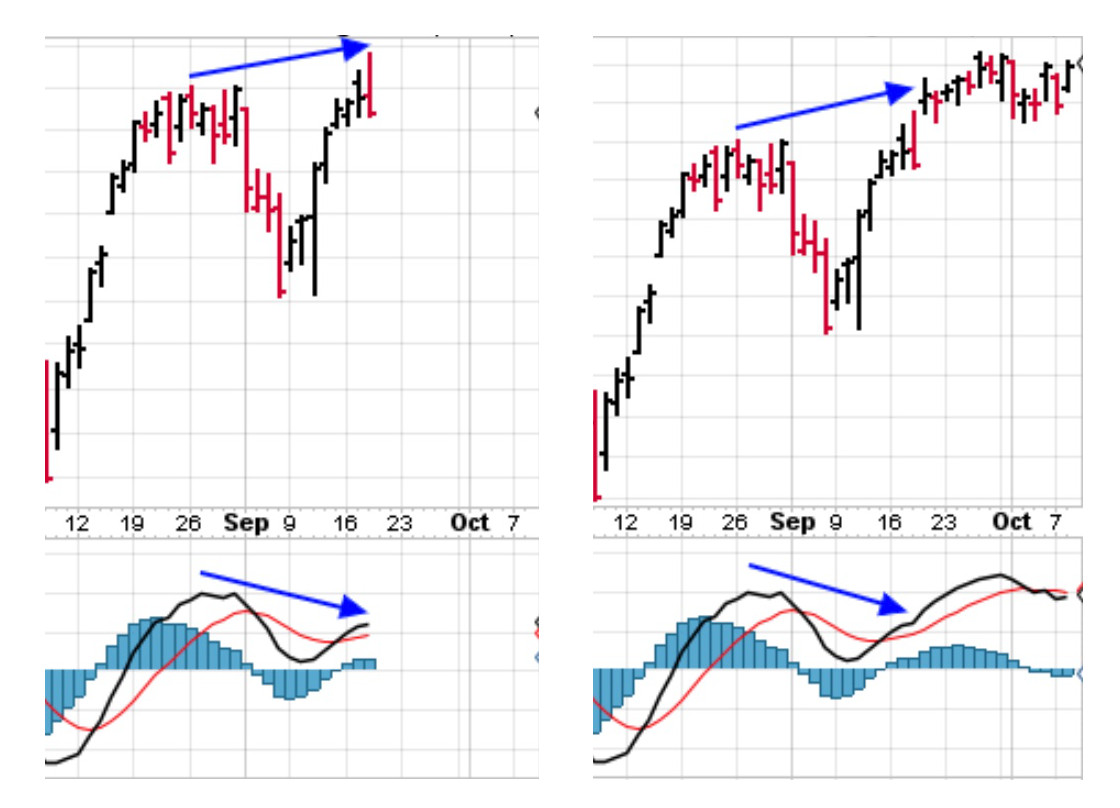

Visual patterns manipulate with the eye

Charting and technical analysis can be deceptive. After years of backtesting and looking at chart patterns, I understand how technical indicators may show a setup in hindsight only if it worked, meaning the pattern failures won’t appear on the chart. This creates an illusion that the indicator has a high win rate, though in live trading it actually doesn’t.

| Textbook example of a clean MACD bearish divergence for a short setup. | Only if it worked. Don’t put this in a textbook, no divergence here. |

In my quant analysis, I’ve come to understand that often my entry and exit signals are not even visually identifiable on the chart, they are only embedded in price data. I look at charts less than before, and usually it’s only price with a few overlays, no oscillators.

I’m not a fund manager

Last year, I realized that I was measuring monthly percentage returns just because everyone else is doing it, not because it served a purpose for my process. Monthly returns seem pure noise for the portfolio management and my long-term mindset. Even the annual outcome of a selected 12-month period (Jan – Dec) that is one calendar year doesn’t help me evaluate strategies and see if their statistical edge is still there. Any single year in terms of performance is meaningless because I’m going after outlier trends that are not linear. So I came up with a much better system to observe and evaluate my strategies. Every 6 months I check the rolling 3-year stats (win rate, avg win/loss ratio, profit factor) for each strategy separately to see how they are performing. I don’t even do it in January and July as one would guess, but in March and September just because I started doing it last March. This measures my goal to compound wealth in uptrending markets and preserve capital in downtrending markets much better. It helps me to keep focus on the process and not shift it to short-term results. I can avoid stress and psychological issues to follow the system better through drawdowns. I enjoy the process more.

I try to focus on my own wealth creation without noise. Let’s face it, retail investors and traders who don’t have to audit their results, calculate their performance in different ways. Most look at their stock account without considering savings accounts, idle cash, pension plans and failed investments, which all dilute the total return on capital by a massive amount. I don’t need to compare my 29% return in 2024 on all of my assets combined to someone who just looked at his or her handful of stocks that performed well. It can create false beliefs that I’m not doing well or need to change. Currency can influence a lot. My 29.3% return in USD was 37.0% in EUR thanks to strong dollar. This is after giving back a portion of open profit in December, so I’m pleased with the result.

Risk, leverage and concentration influence the return profile. It’s a matter of finding a healthy balance for your own portfolio, cause chasing high returns alone can be awesome in one year and a nightmare in another. Risk management by definition dilutes the absolute return to stay in the game.

Professional athletes need to work on their mindset, the same applies to traders.

I’m a private trader. I can choose what’s best for me to make money. It doesn’t mean that others need to agree with me or start adopting the same principles. Do what’s right for your own process. One of the signs of becoming a mature trader or investor is that you stop following other people’s decisions to make your own. Now onto a successful 2025!

Share this post

2 replies on “2024 might be my biggest learning year yet”

“I need to identify the assets that see the biggest money inflows and position my capital accordingly.”

I’m wondering how are you identifying the assets with the biggest money inflows in practice? (I have got an impression that you are focusing on price and price-based indicators, and not really looking at the volume and volume-based indicators.)

It is price-based movements in US large cap stocks, where institutional money flows around, that suggest possible leaders under accumulation. Simply put, it’s betting on rising stocks with momentum, but before they become so obvious that everyone knows about it. By the time it’s in the headlines, the upmove has already been significant. I need to place a number of bets and not every stock will be a winner, so position management plays a role. The main idea is not about picking the right stocks, but letting winners run without trying to predict how far they can go. It can be tough on the human psyche, and that’s why it’s so rewarding.