The stock market has upside bias in long-term, but shorting can actually offset downside risk due to having negative correlation to long exposure. When one side is losing money, the other side often tends to make money at the same time. It doesn’t mean they only balance each other out and give a breakeven result which wouldn’t make sense, but the idea is to have a profitable edge on both sides and smooth out the equity curve by letting them offset directional risk over a longer period of time.

Markets go both ways

When I first started trading stocks I immediately added the short side in my trading plan to get used to the fact that I can capitalize on market moves in both ways. My first strategy was a mean-reversion style that anticipates to buy possible double bottoms and sell short double tops. These are swing trades that I typically hold for a few weeks. I haven’t found a way to trend-follow stocks on the short side. Sharp rebounds and frequent recoveries make it a struggling endeavor. Backtesting the last 30 years shows it paid off well only in the early 2000s and 2008. Therefore, I preserve capital by going into cash during higher volatility and downtrends. This cash can earn risk-free interest when the market is going down.

Need to anticipate a move before it’s clear

I never gave up researching the short side and I have made some progress in the past couple of years. First, I figured out I don’t need to short in bear markets cause I’m already in cash by then, market risk is off and I’m earning interest on my cash balance. I need to short over-extended market rallies or weakening momentum in uptrend, when my long exposure is most vulnerable to trend reversals. It helps to even out market risk and make the overall equity curve smoother.

Why short something against a long position if I can just close out the position or sell some of it?! The strongest market leaders are often the quickest to bounce back and recover, so taking it off during a pullback is just a bad idea that often ends with buying it back at a higher price. Also, I don’t mean shorting a single stock against a position, but rather a basket of correlated stocks that are weaker in relative strength or just the sector ETF. I need to position the portfolio into shorts before there’s blood in the streets. It’s too late to start shorting when the market has already plummeted to oversold conditions cause everyone is aware of the fact by then and a relief rally often follows. The stock market is a highly competitive game that is played for each other’s money, so being a step ahead of the crowd is necessary.

Trading longs and shorts

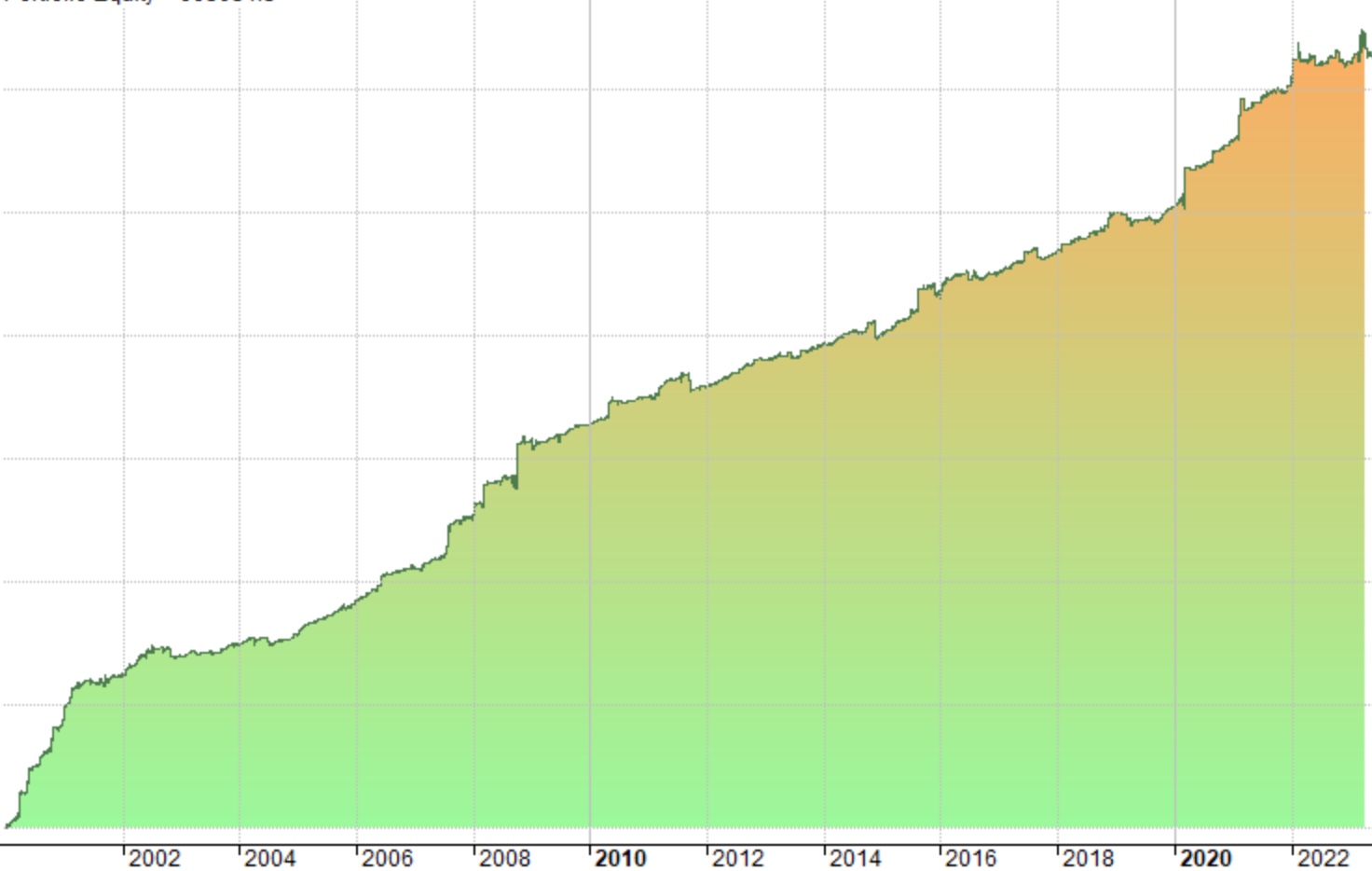

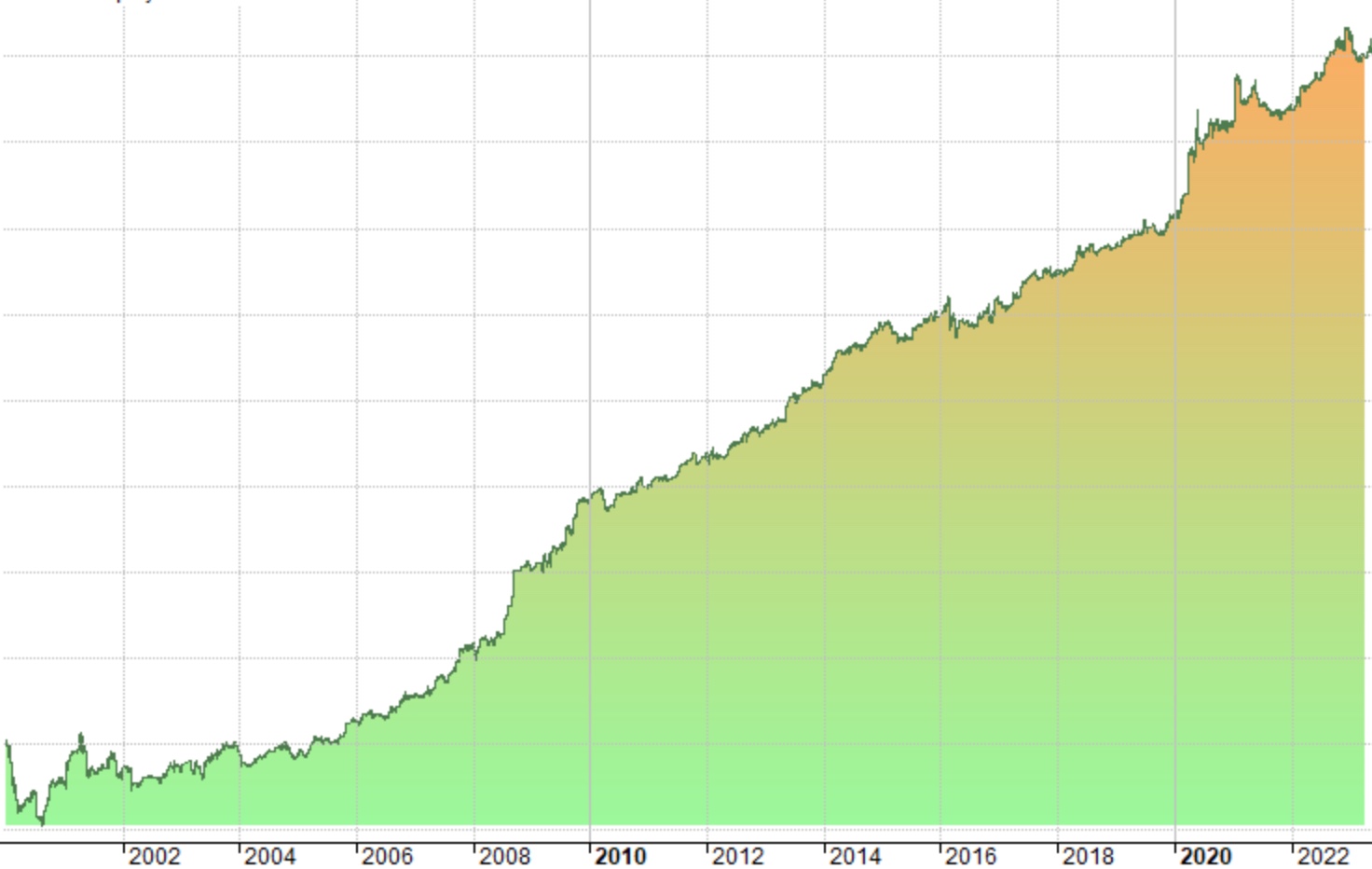

I run short-term swing and intraday strategies both long and short regardless of the market direction, and I like to see how they compensate each other over time. When one zigs, the other zags, meaning while the long strategy may be in a drawdown, the short side is making new equity highs and vice versa. Put together they create a smooth upwards pointing equity curve. I noticed it in backtesting a few years ago and I recently noticed it again in live trading. My long daytrades were getting hammered on a down day, but the shorts made it all back. This may sound like a breakeven scenario, but actually if both strategies have edge and positive expectancy in long-term, then the numbers will play out for an overall profit. Let me illustrate it below.

See the equity curves of my daytrade algorithm (last backtest generated a year ago), the first is long and the second is short side. Both are good profitable strategies on their own and I’m running them now. When the long had pullbacks in 2011, 2014, 2019, 2022 the short was making money at the time. When the short was weak in early 2000s, 2010, 2016, 2021 the long was strong at the exact same times. I believe running a diversified basket of uncorrelated strategies is the closest to holy grail in trading. It’s something that Jim Simons was able to achieve at Renaissance.

Hedging downside risk

Another finding about shorting to mitigate risks is that a hedging strategy doesn’t even need to be profitable on its own to increase the portfolio’s overall returns. It may sound silly, like how can an unprofitable strategy make the portfolio better?! However, the math behind it is that if a strategy wins money in short-term during periods when everything else in the portfolio is losing, then it can actually increase the overall compounding effect by limiting losing periods even if the strategy alone is not making money in long-term. Let’s say your hedging strategy keeps the portfolio’s -50% drawdown to -25%, but over 10 years the strategy itself is slightly negative, then it can still have a highly positive impact on total returns. In fact, hedges are usually a cost, meaning they are expected to lose money over time, but can significantly help to preserve capital when it’s most needed.

This is not a recommendation to start shorting. One should do proper research and understand all the risks involved. Any sort of trading or investing can lose money. Shorting is feared because the possible upside move is unlimited, therefore risk of loss is unlimited in theory. Though there is overnight gap risk even if using a stop loss, there are additional tools to manage risk like position sizing, options, futures and ETFs. Hopefully it gives some food for thought if you read my last post and wondered how I fill the holes in equity curve.

Share this post