Happy New Year!

Absolute performance measures the annual returns of a portfolio, while relative performance compares it to a benchmark or some index. Part of our human nature is to compare what we have or achieve to someone else be it a friend, neighbor, co-worker etc. We may be satisfied with our new car until we see that our neighbor has just got a much better one. Social media presents us images of perfect lives daily that make many envy thinking that others are living a much better life, while it’s often actually a fake facade. Wall Street loves the flaw of human nature that we constantly keep comparing our returns in the market to other participants because it creates style drift and performance chasing, which on its own create commissions and fees. Add recency bias which makes investors chase the current hot thing showing the best recent performance, and in the end there’s a group of unhappy punters disappointed in the markets.

Though I follow the S&P 500 index weekly because I mostly trade that market, I try not to compare my results to it too often. I know my trading system can underperform in short-term, even any single year has an insignificant meaning compared to the benchmark because I have built it to outperform the averages in the long run.

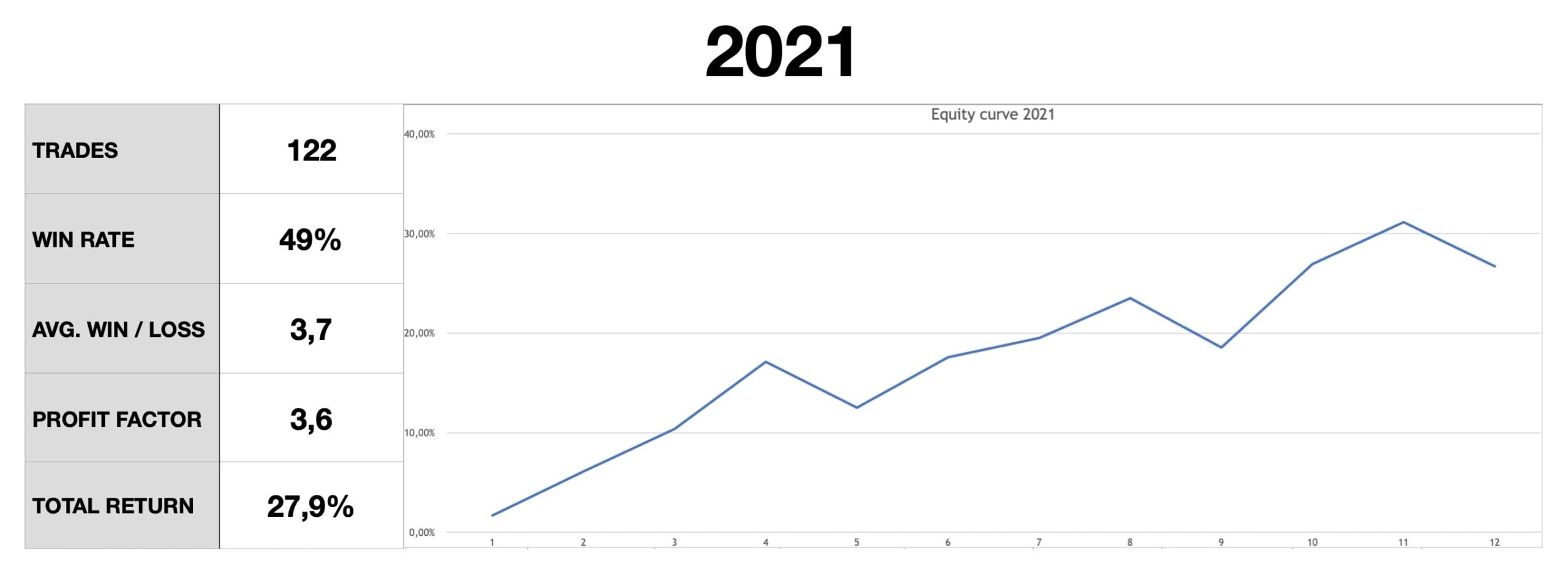

Here are my results for the trading year of 2021. I had 122 trades in total and almost half of them being winners, which is expected for my trading system. I’m not trying to be right, but to make money. Therefore, I’m aiming for bigger winners compared to losers. My average win was 3,7 times the average loss, which is very good. Profit factor that compares total $ win to total $ loss, was also good being 3,6. It means I made $3,6 for every dollar lost.

The annual return of my total portfolio was 27,9% in 2021. It’s the return of all of my assets including stocks, crypto, gold and cash. I don’t have any separate retirement or buy-and-hold account. That’s why I don’t aim for the highest return, but to manage risks and compound risk premium over time. I’m satisfied with the result as my expectation is to achieve around 20% average annual return over a longer time period. A rising equity curve with shallow pullbacks is what I like to see.

There’s no reason to be unhappy when traders online show triple digit annual returns. They most probably do it with a small part of their assets that allows to take on much more risk and occasionally blow up. Focus on your own growth as a trader. Learn, practice step by step and follow the process, no need to worry about others. Absolute performance will change your life, not relative performance!

Share this post