Amateurs are looking for the next winning trade, pros know that trading is a long-term process of cutting losers and adding to winners. Market behavior is too random to predict the outcome of your next trade. Therefore, focus on things you can control and that is process, not results.

There are few simple stats I follow to measure my performance. I summed up my trading for 2019, see some key figures below:

Overall: Win rate 54%; avg. win / loss 2,23; profit factor 2,64.

Longs: Win rate 60%; avg. win / loss 2,40; profit factor 4,22.

Shorts: Win rate 50%; avg. win / loss 0,94; profit factor 0,92.

So overall, I had slightly more winners than losers, my average win was 2,23 times bigger than average loss, and in total dollar amount my win to loss was 2,64 meaning that for every dollar lost I made $2,64. I am satisfied with the results, tho the overall profit factor could be at least 3. As you can see, my longs performed better but the shorts actually lost some money and pulled down the overall results. I was bearish at the beginning of 2019 cause I was anticipating the market to re-test the deep decline of Dec ’18. At some point I got rid of the outcome bias and focused on what the charts were telling me, the market was going up.

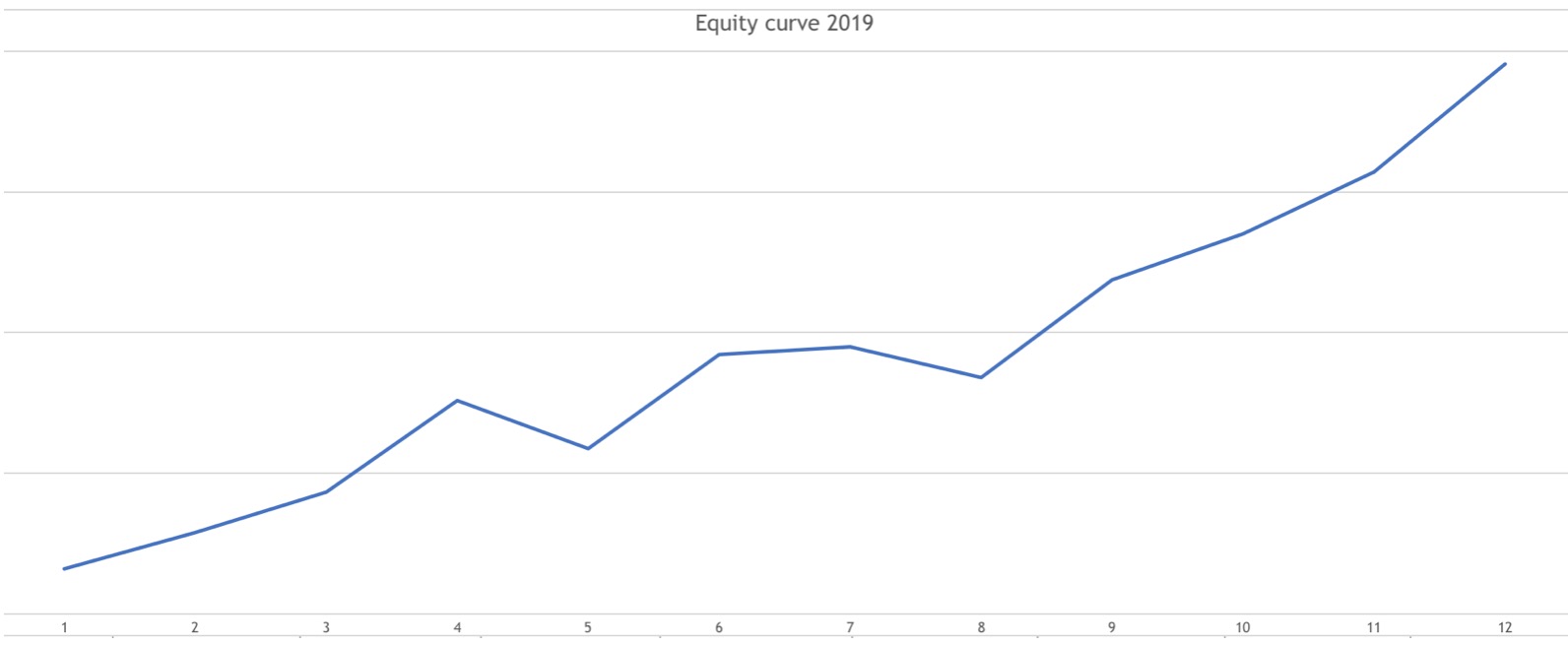

Below is my smooth monthly equity curve for 2019. Total return was in double digits but below $SPX (+28%). In raging bull markets the goal is to be long in the market and not worry about beating the market, the edge will play out in the long run.

I want to share a trade with you from late 2019. PCG hit my scanner as a potential long candidate. When the trade setup triggered, I remembered from the news that the company had filed for bankruptcy protection because of the accusations for the California wildfires. The price had fallen a lot but it’s not too comfortable to buy a company that might go to bankrupt soon. I respected my trading system and went long PCG in November (green arrow). For several days after entry I was thinking whether it was a good idea but I made up my mind to follow the process and not have an outcome bias. After going sideways for couple of weeks the trade worked out just to my target (red arrow is exit) and returned +70%. It shows again to follow trading plan and not to trust gut feeling.

Focusing on results will have outcome biases. You will start to trade your profit/loss figures and dollar amounts rather than the price action on a chart.

You don’t know where the price is going but you make a bet and manage it according to your rules.

Lesson Learned: Focus on process, not results.

Share this post