Claude Shannon was an American mathematician, cryptographer, engineer and computer scientist who lived in the 20th century and died in 2001 aged 84. Sometime in the 1960s at MIT he came to a theory of rebalancing that is now called Shannon’s Demon. I saw it randomly already a few years ago on the web and stumbled upon it again now while learning index options. Here’s the concept in a nutshell.

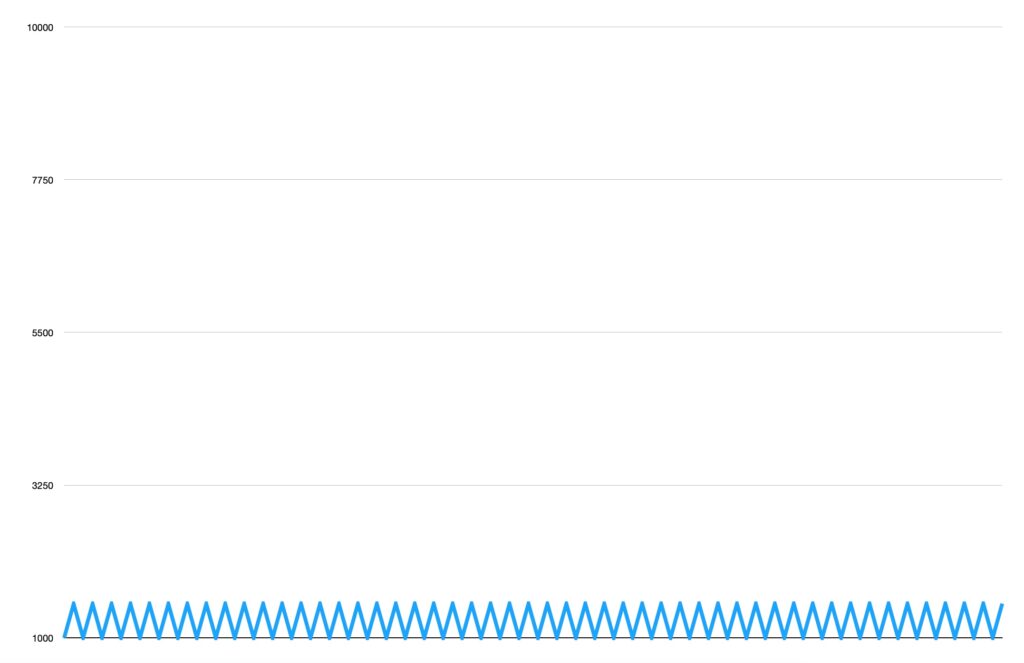

If we have a hundred coin flips with 50/50 odds and each time we either win or lose $500, then in a perfect distribution of coin flips it would look like the outcome below. The equity curve starts with $1000 and keeps winning or losing $500, which makes it flat overall and the expectancy is zero.

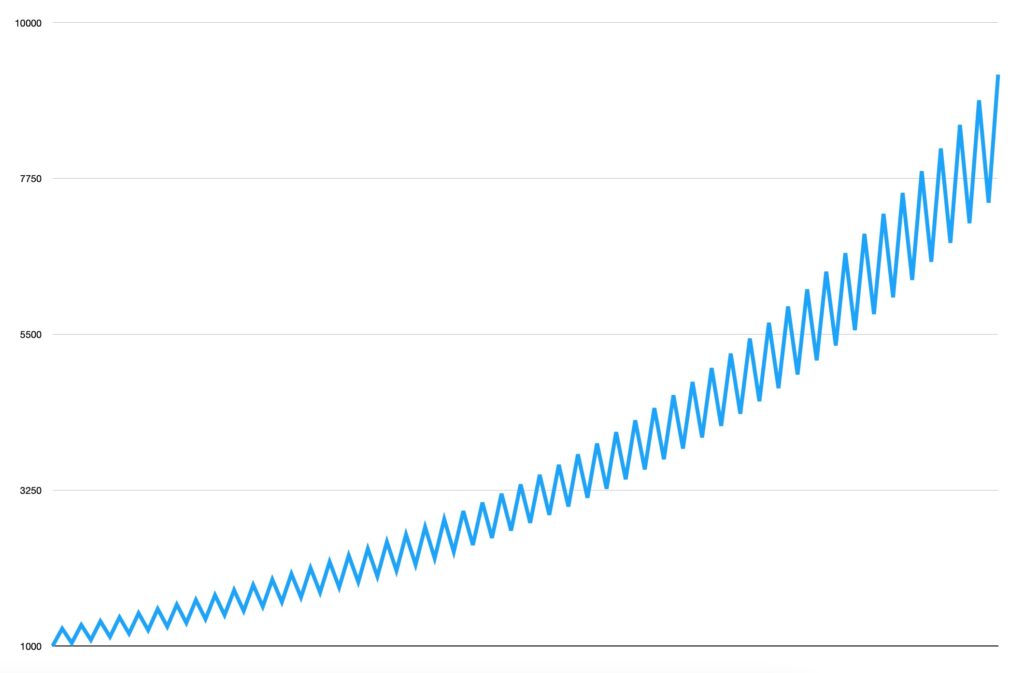

Next, we do the exact same exercise but rebalance 50% into cash after each coin flip and bet the other half on the next flip with the same equal opportunity to win or lose like in our first example, however now as the equity changes, the $500 outcome will change accordingly, keeping it constant in percentages. You can see below how the equity curve has changed and the outcome now has positive expectancy. It went from $1000 to $9000 in one hundred coin flips.

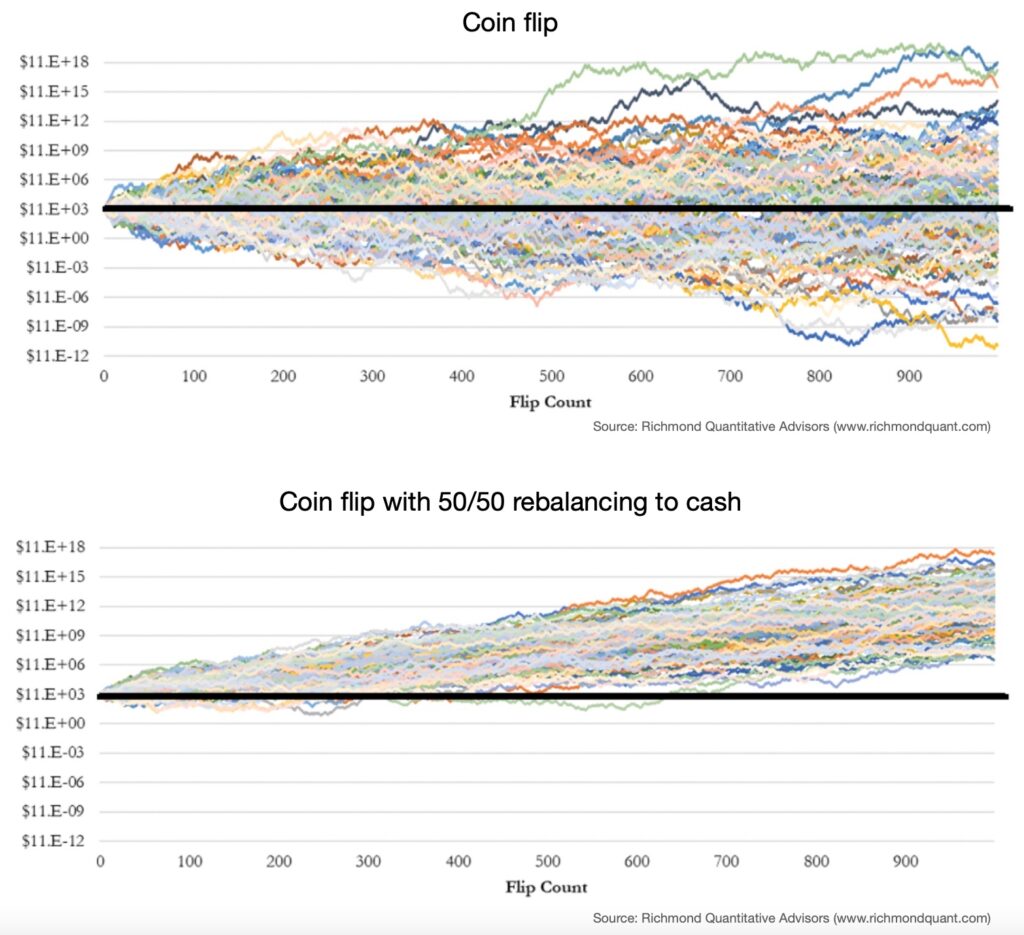

These examples show a perfect distribution of coin flips if the odds are 50/50, but we know that in real life we can have several heads or tails in a row. I found a Monte Carlo simulation done by Richmond Quantitative Advisors on their website, where they show that over a thousand simulation runs of a thousand coin flips each time, the concept maintains its edge. In the first graph below, the regular coin flip has some occurences positive and some negative, showing proof of the zero expectancy overall. The second graph below shows how the 50/50 rebalancing into cash makes all the simulation occurences end in positive territory.

Other sources on the web explained the concept by volatility drag, which means that by putting together two uncorrelated assets or strategies with zero expectancy (cash also has zero expectancy in absolute numbers) they mitigate downside volatility and contribute to upside return.

I think it works for two reasons:

1. Due to rebalancing, some profit is taken off the table after a win and cash is added after a loss, which positions capital more efficiently for the following bet.

2. Compounding comes into play because equity starts to change. When the outcome was fixed at $500, there was no compounding effect, but with growing capital it starts to play a role.

Putting it to work in SPX 0DTE options market

I have thought about this concept in my 0DTE options trading, where I can apply daily rebalancing to day-trading and therefore benefit from the daily compounding. I’ll show you what I mean with the following backtest.

It’s a day-trade strategy in SPX 0DTE options, which enters bull put and bear call vertical spreads throughout the day for net credit. The goal is to have these options expire out-the-money while managing risks in case the market moves against a position.

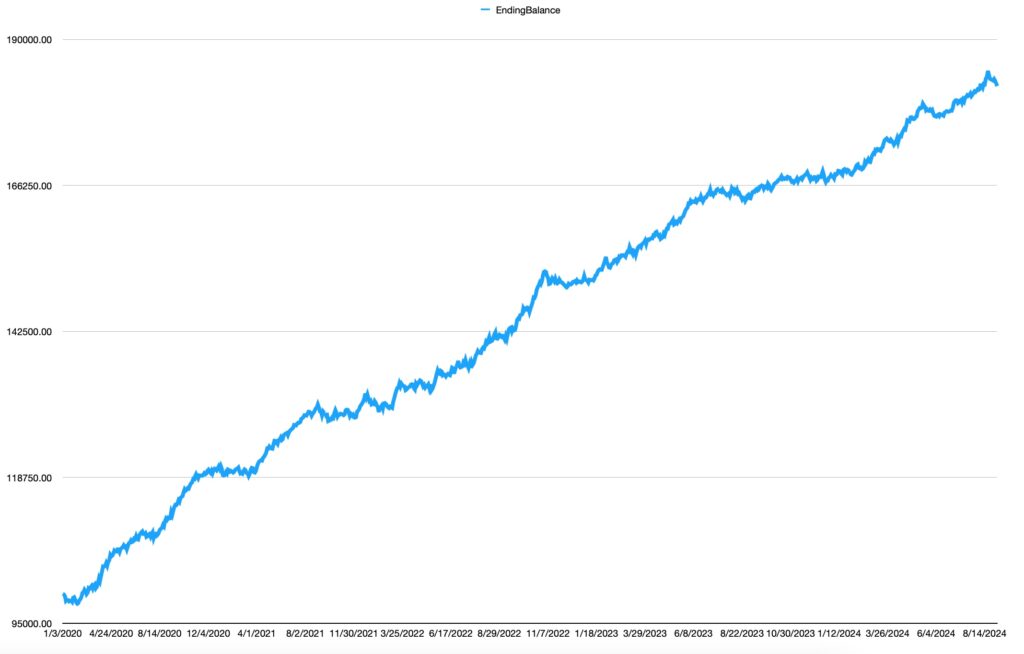

Up until May 2022, SPX had three weekly expiries (Mon, Wed, Fri), but then CBOE added Tuesdays and Thursdays, so since then we can trade 0DTEs every day of the week. The backtest includes all the days 0DTE was available. The period is January 2020 – August 2024.

The first chart below shows the backtest with 1 SPX options contract, but still multiple entries throughout the day. Starting with $100k at the beginning of 2020, the account grew to $182k by the end of August 2024.

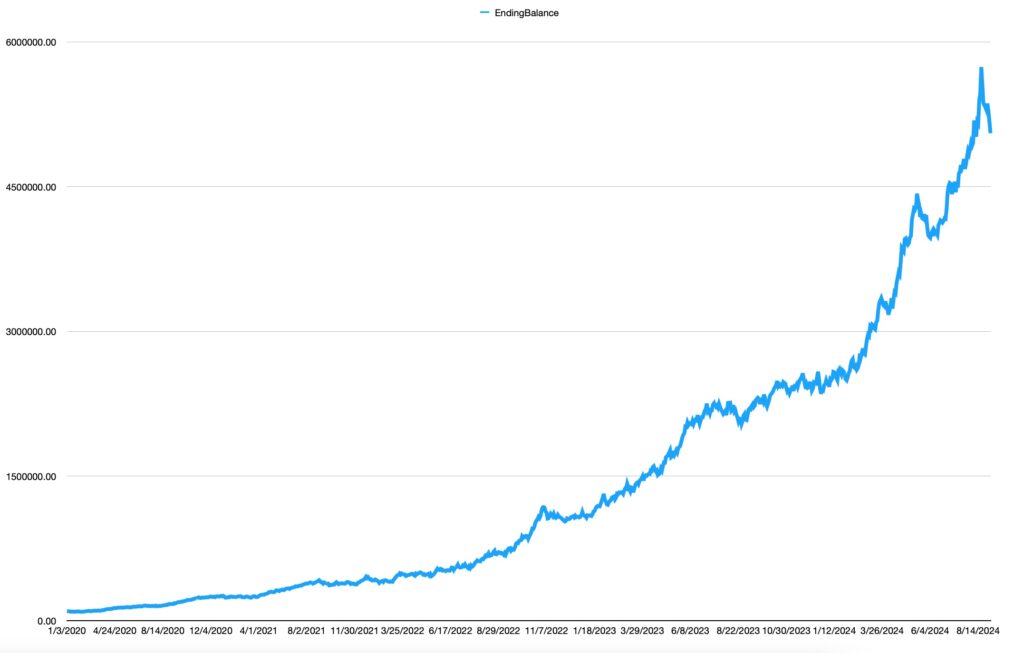

The next chart shows the exact same strategy with the same multiple entries throughout the day, but instead of a fixed 1 contract path it now uses 50% of buying power to add as many contracts as possible to compound the account along the way. It rebalances each day to use 50% of the account’s buying power at the start of a new session. $100k grew to over $5M with some violent drawdowns as you can see on the chart. It shows how compounding can work like magic if the strategy holds up and delivers. This is a backtest of course, but I’ve been trading this style for 2 years, without such aggressive sizing though. I can’t make the strategy public here, but the point of this exercise is to show how any decent trading strategy can work great with proper position sizing and rebalancing thanks to the compounding effect.

Real life trading is different

A backtest is just a simulation, where a set of rules have been applied to a dataset. In live trading, we need to deal with all kinds of issues like getting fills, slippage, software bugs, technical errors, losing power or the internet etc. Here’s an example of my recent shenanigans in the options market that cost me several thousand dollars, which hurt the strategy but was just a small scratch for the overall portfolio, further proving the importance of position sizing.

15 minutes into the close, I had one $3 buy order filled at $29 and another one at $14 while the underlying market itself didn’t move much and other correlated options markets (SPY, ES) were also quiet. This means my $300 trade got executed for $2900 and another for $1400 per contract, creating a total loss of several thousand dollars in price slippage in an options market that should be the most liquid in the world, trading over $500 billion in notional value daily. So what happened?! It seemed that market makers dropped liquidity and widened bid-ask spreads, which made prices shoot up like 1000% just for a second and it came back down in the same minute. For example, my $29 fill was off the price chart as the chart below shows that $20 was the highest price for that option.

Anything can happen in the markets and I take responsibility for my trades. I did manage to fill a trade bust request at my broker in 29 minutes after the trade (the limit for 0DTE is 30min), which is meant to turn back erroneous fills that happen outside the fair market action, but the first response was negative. They are still investigating what happened that day and why my trade is off the chart, but from prior experience and talking to other traders, I don’t expect anything from it. This game is about extracting money from others. You are on your own. I will update the post if I do get a reply.

Having observed the stop triggering patterns over the past month with high slippages and prices off the charts while the market hasn’t moved a lot and correlated options markets like SPY and ES at other exchanges have been quiet, it’s clear that my money didn’t go to some retail punter at the other side of the trade but it went straight into CBOE’s market maker’s pocket. They control the SPX options market by widening bid-ask spreads and can influence prices to their liking, so this is something we need to accept and deal with as market speculators. The game is rigged but we can turn these created inefficiencies to our favor.

Update 12 Nov 2024: After 6 weeks of investigation, I got a reply from my broker saying that the trades were valid, they couldn’t review my trade bust request in time and they don’t have the obligation to do so.

Share this post