Simply put, compounding means money makes money that makes money that makes money. So, instead of thinking about returns in a linear fashion, compounding actually illustrates the exponential growth of assets over time, which is as important for a trader as it is for an investor.

Let go of the short-term mindset

Beginning traders and punters with no plan pay most attention to being right. They care most about the next trade being a winner. They don’t look at the bigger picture of compounding returns over a longer time horizon, that is much more powerful than having a winning trade today or tomorrow.

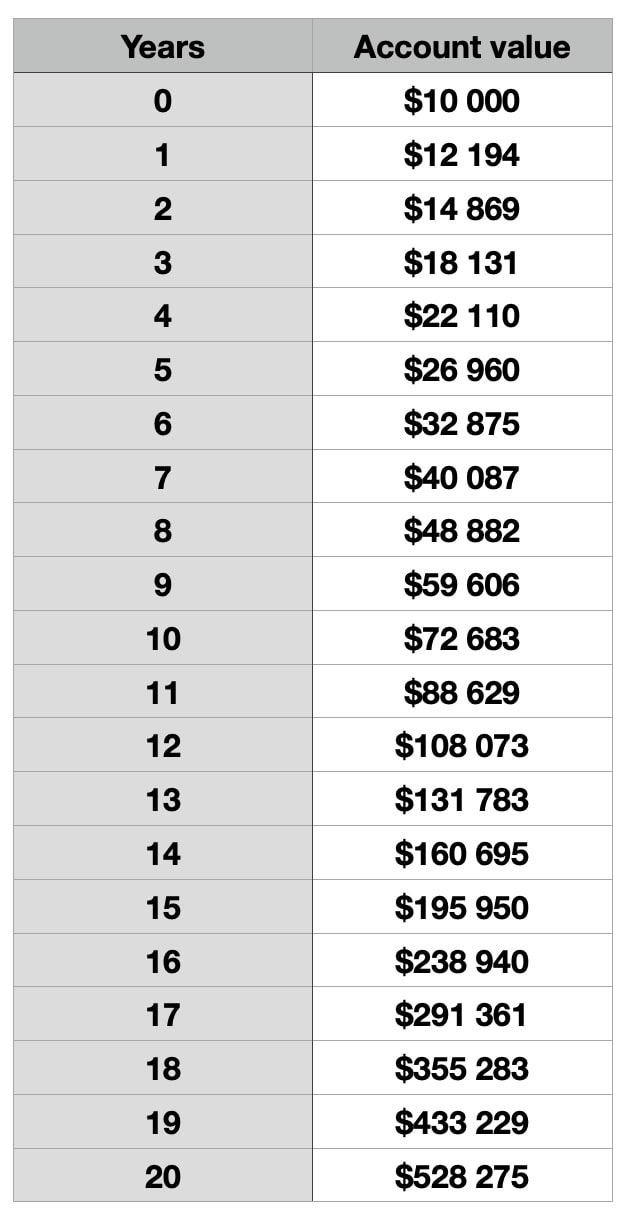

Let’s look at the simplified table on the right, where a trader starts with $10k, has annual return of 20% and compounding takes effect on a monthly basis. The annual returns will obviously differ year by year in real life, but let’s just take this as an example to illustrate math.

Let’s look at the simplified table on the right, where a trader starts with $10k, has annual return of 20% and compounding takes effect on a monthly basis. The annual returns will obviously differ year by year in real life, but let’s just take this as an example to illustrate math.

You would think that making 20% a year on $10k means earning $2k in a year, that is $40k profit in 20 years. However, if you compound your return monthly and still keep making 20% a year, the $10k account will be worth over $500k after 20 years! This is because money you make will also be making money. Of course, it’s harder to compound if daily expenses are covered with trading income, like it is for me. And that is why I encourage people not to leave their day job too early, or to take trading as a side business, but that’s a separate topic for another time.

Compounding can work against you

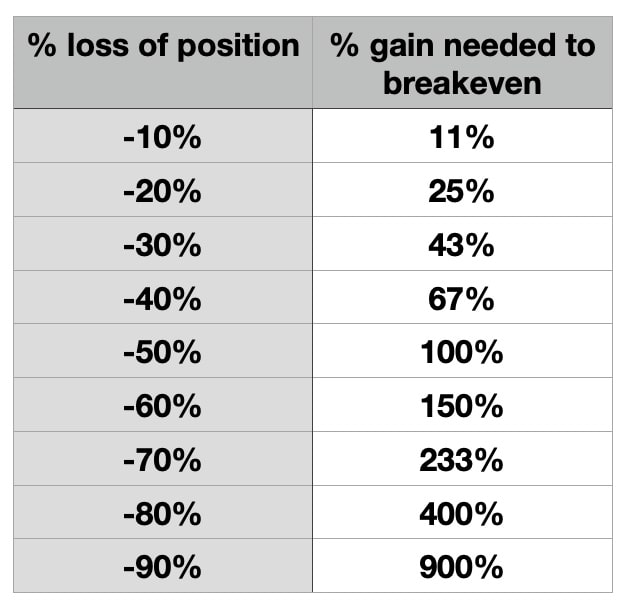

Now we’ll look at the other side of the coin. Big losses and deep drawdowns kill the compounding to date.

If the account loses -10% in value, it will take 11% gain to get back to breakeven. However, a -50% loss will need the rest of the money to be doubled (100% gain) to get back to breakeven and -90% needs a 900% gain, which would be a very hard and stressful experience to go through.

If the account loses -10% in value, it will take 11% gain to get back to breakeven. However, a -50% loss will need the rest of the money to be doubled (100% gain) to get back to breakeven and -90% needs a 900% gain, which would be a very hard and stressful experience to go through.

That’s why it’s so important to limit losses and let winners create the upside in your portfolio. A sustained bear market is the enemy of an investor, and holding on to losers wipes out a trader.

Process over outcome

I’m sharing my annual return since 2017 in this blog. In trading, one takes calculated bets with reasonable risk / reward setups to earn risk premium. For me as a quant, it’s not a question about the highest absolute return, but it’s much more important how much risk is introduced to the system and how to use capital more efficiently to seize opportunities. Taking a lot of risk and playing in the risk of ruin territory could bring punters amazing short-term returns, but I’m treating trading as a business to survive in the highly competitive markets, and not manipulating with survivorship bias here. For every trader who made unrealistic returns in a very short time window, there were 1000 others who tried the same and blew up their account. Furthermore, it’s usually a matter of time, when gamblers give back the profit and more.

Markets go up and down, therefore trading performance also fluctuates in time. I have experienced enough market moves that I don’t get excited about the outcome of a single trade, and I ignore someone bragging about their short-term returns. It just doesn’t matter.

Share this post