First off, my trading timeframes vary from short to intermediate, but I am looking at the bigger picture to compound risk premium over time in the US stock market. I like to build quantitative trading systems that don’t need me in front of the screens during market hours.

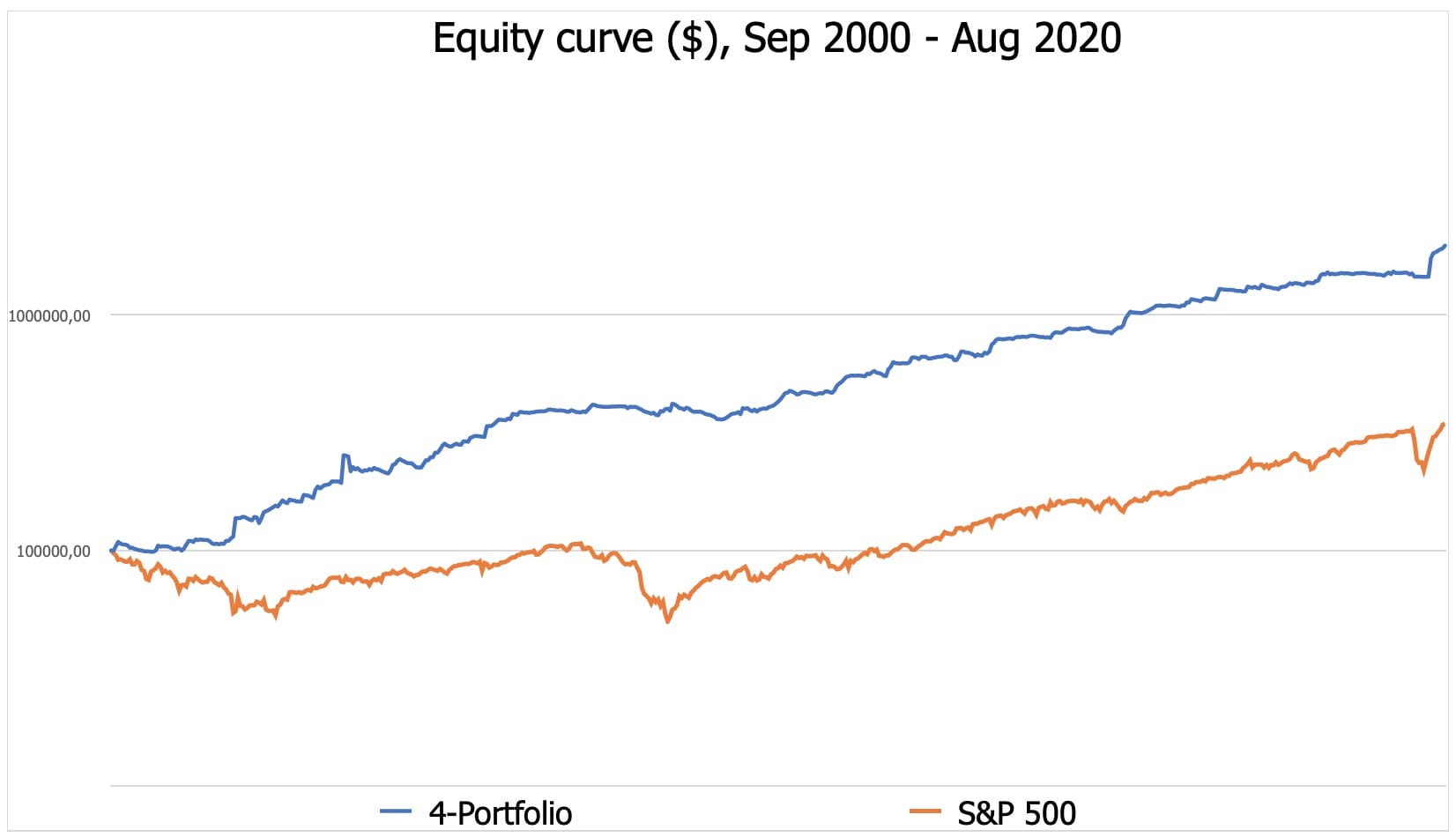

I had been swing trading and studying technical analysis for couple of years when I started backtesting and optimizing my rule-based ideas in the midst of 2019. I’ve been using spreadsheets and price charts to manually backtest (paper trade) systems on historical data, mostly starting from 2000 when modern technology started to revolutionize financial markets. After working on each trading system separately, I constructed a portfolio of four systems that made the cut. Below is its performance for the last 20 years period.

The four strategies complement each other in changing market regimes; including styles of trend, momentum and mean-reversion; positions are taken long and short.

The main principles for creating my trading systems are:

1. Theory-driven, no data mining.

2. Robust and simple, no curve-fitting to any specific period or market condition.

3. Take small losses, let profits run, add to winners.

4. Try to break the system, not to prove it.

Below is the summarized backtest of four systems (4-Portfolio) from Sep 2000 to Aug 2020, over 1000 trades with win rate of 48% and profit factor of 2,78. Fees, slippage and dividends are included in data.

The log-scale equity curve is based on closed trades and the S&P 500 index respectively (dividends reinvested), the right edge represents some open profit. There were years when it didn’t perform so well, which would probably have tempted many to scratch it and move on. My 4-Portfolio (blue) outperformed the S&P 500 index (orange) significantly with less volatility. With $100k starting capital, the 4-Portfolio account had grown to $1,97M while the S&P 500 account had grown to $343k in the same 20 years time. I must note that with dynamic money management rules, the portfolio can occasionally be modestly leveraged while the index account in this example is not. The ’00s was one of the worst decades in US stock market history and the ’10s was one of the best. It’s interesting to note that running the comparison to index for the last 10 years only, the final results of the two did not differ that much.

| 4-Portfolio | S&P 500 |

|---|---|

| CAGR: 16,06% | CAGR: 6,36% |

| Volatility: 12,37% | Volatility: 17,17% |

| MaxDD: -16,21% | MaxDD: -55,2% |

What I learned from this exercise:

– Sitting on sidelines waiting for the best setup can often underperform the market because a lot of moves are missed.

– Need to accept random price moves even for the best trading signals.

– A system with high profit factor can be no good if it rarely gives any trade. A less profitable system with higher trade frequency can bring better returns.

– The correlation of holdings or strategies in a portfolio should be kept as uncorrelated as possible. Otherwise, risk allocation could give a false illusion of diversification while in fact, all positions will tend to move together, which is particularly significant in a market crash.

– Good ideas often turn out to be bad when tested, because when quantified they don’t give enough positive expectancy to be considered.

– Annual return may vary a lot. Portfolio is in a drawdown most of the time (not hitting equity ATH) and even a good system can stay flat for a year or longer.

– Compounding works wonders, but also for losses.

– Short-term ebb and flow in equity is irrelevant in the long run.

– Instead of looking only at absolute returns, it’s important to consider the risk and volatility to get there.

The future will obviously be unique, but following a tested roadmap gives confidence and restful sleep. While the systems have been running live for some time now, gathering real results will continue to forward test it with out-of-sample analysis, ables to apply walk forward analysis on a longer timescale to keep optimization viable. My plan is to bring more automation into the process, switch from manual backtesting to software, keep crunching data and test new trading ideas. Overall, I am pleased with the results and it created a foundation to work on.

Share this post