I’ve been writing book reviews and less about my own trading in recent times. Though 2020 has been good to me in regard to trading, I’m not overly excited about this. It just shows my strategies have been well in sync with the market and also hard work has started to pay off. I have several good books in my reading list to keep me busy which I will review in this blog. I’ve also been tinkering with AmiBroker software to develop my quant skills.

Based on my own experience to date – is trading art or science? It’s a philosophical question. I guess it could be answered looking at different angles.

When I began trading a discretionary style it was definitely more of an art. Looking at charts, working with patterns and trying to anticipate a possible future move feels like art. Considering the fact that markets are made of crowds of humans who interact with each other and every market participant sees the world in a different view, some are bullish some bearish towards the same event, indeed confirms the artistic feel.

Further down the road I started to systemize my trading. Setting fixed rules for entries and exits, calculating position sizing and having strict risk management have turned the process more into science. Backtesting trading ideas, optimizing parameters and letting the odds play out is about mathematics. When creating and running quant strategies with AmiBroker, a trader doesn’t necessarily even need to look at charts, the buy and sell signals will be printed out as plain numbers. One needs to know how to code a bit with this particular software.

As long as coming up with new trading systems involves theory and logic rather than just empirical approach, there will still be art and discretion even in systematic trading. I find trading to be a combination of art and science, at least for myself. I keep working with charts and patterns but I like to automize the process using maths.

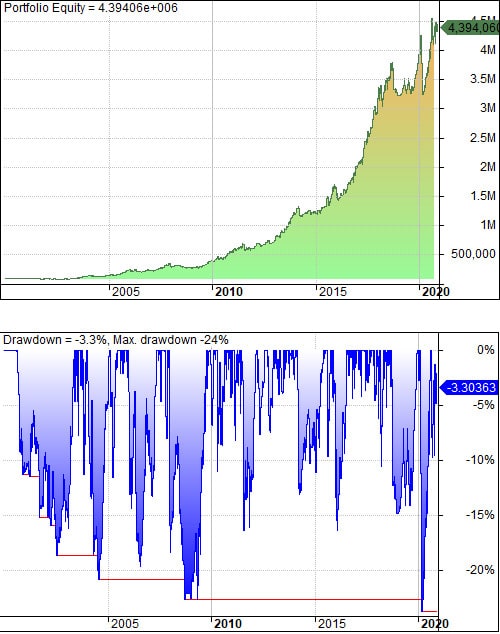

Just to give a brief example of how I’ve been learning to code my trading. I backtested a trading idea of a long-only portfolio of 10 stocks. It took a compounded annual return of 20% to turn a $100k account into $4M in 20 years. These 107 trades had 55% win rate, profit factor over 10 and MaxDD -24% along the way. Obviously there are many biases tied to such tests as the future will not play out as a backtest. However, proper stress testing can give an idea of a thousand different ways it could have played out to see if the odds are in your favor or not.