I’ve been thinking about the structural changes in the financial industry. I really think the markets have had a huge shift in the past 5-6 years just like there was a shift from trading floors to electronic trading in the late ’90s – early 2000s, which changed the way people participated in the markets. It therefore changed trading edges and price patterns. This time it’s about three factors in my mind. First, there’s a huge rise of participation. Investing seminars, courses, influencers, retail investors chasing financial freedom etc. Secondly, the rise of derivatives like short-term options, levered ETFs, CFDs, but also cryptocurrencies becoming more mainstream that possess higher volatility. And the third thing is technological advancements like automation software, backtesting and algorithms becoming more available to retail investors and traders. These factors influence trading edges and price patterns.

Everyone has their personal stock analyst for zero cost now

I asked the free version of ChatGPT to analyze the S&P 500 chart and the analysis it gave me using a chart from TradingView was actually very well outlined. Of course, it doesn’t mean I would trade it that way or that the analysis itself was going to make money. But if such AI models are already able to analyze stock charts like people do, then who needs investment advisors, market analysts or finfluencers?! I can ask for support and resistance lines on a chart, and I bet it could also outline the fundamentals of the company if I asked.

I don’t expect any edge from these analyses, either from AI models or human analysts. When you’ve been in this game for long enough, you realize that analyzing and trading the market are two very different things. That’s why you hear analysts talk a lot about the markets but never about any trades, cause they don’t actually put money at risk. Their job is safe, kind of like the ChatGPT’s, that is to make up a story.

AI learns from the masses

I also asked ChatGPT about options trading. It was a pleasure to see it describe some key principles in the opposite way to what I am doing myself, because these AI models learn from public information and therefore represent what the majority is doing in the markets. We all know that the majority loses money trading the markets, so I’m happy to take the opposite side of what ChatGPT is telling me.

Fine tuning strategies with leverage

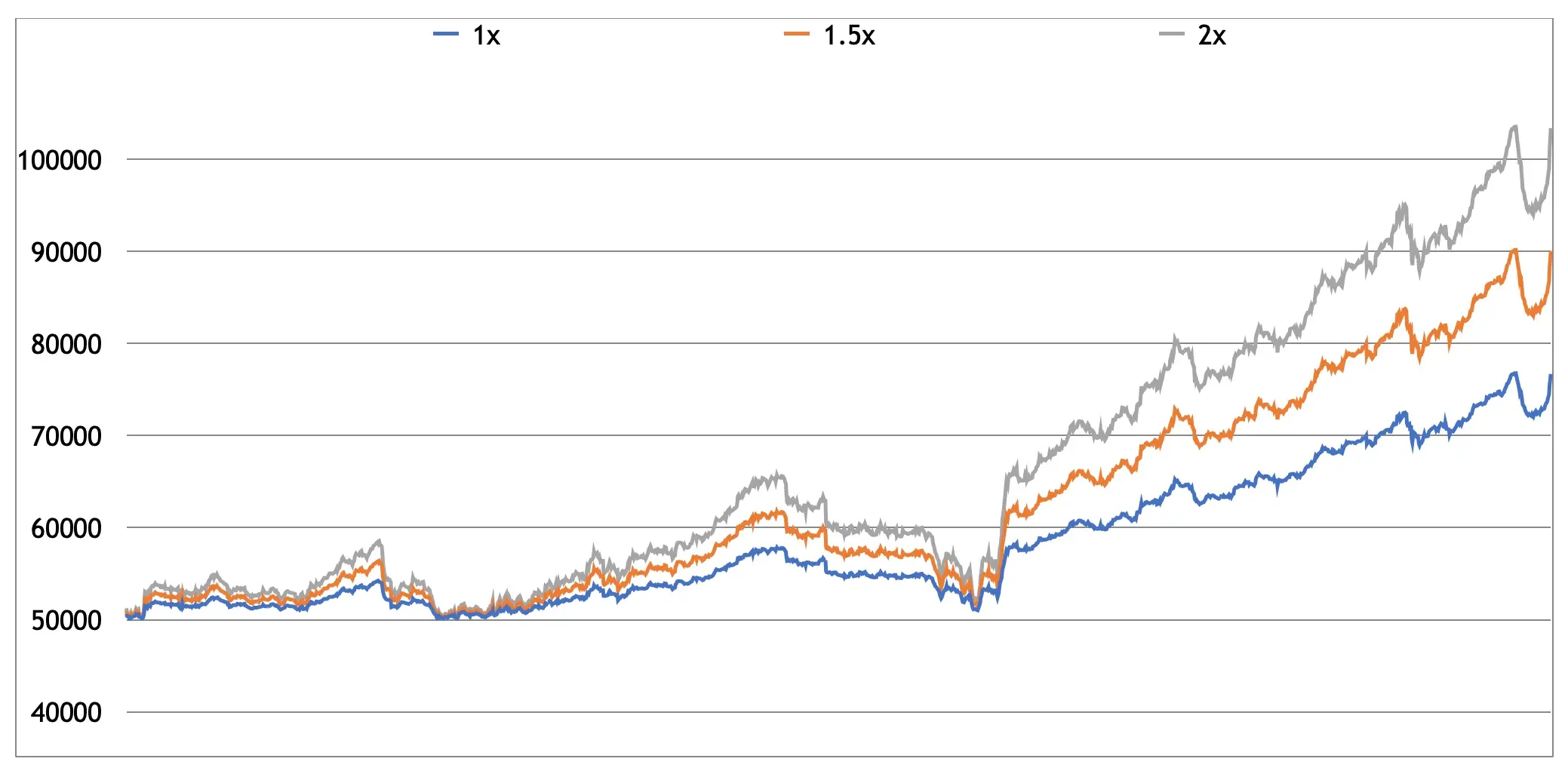

Lately, I’ve been thinking more about capital efficiency. The point is to put money to work in the markets using robust trading edges, but in a way that would make the most of the capital deployed. It comes down to allocations, position sizing and rebalancing, but also trying to cut fees, commissions and other trading related expenses like software, data and services. In the end, it’s all about math and if it plays out in numbers. It’s like running any other profitable business. I like to crunch data, so I was playing around with applying leverage to my short-term stock trading algorithm. The chart below shows an equity curve of my recent real trades long and short in a high frequency trading program, so it already takes into account fees and slippage. The data points are trades, not days. On some days there can be tens of trades executed.

I currently trade the 1x version that is the blue line. Applying leverage of 1.5x or 2x will obviously increase the upside if the strategy works well, but it also comes with higher volatility. In this chart, the drawdowns don’t look too bad even for the 2x version, but I need to be prepared for a different future, where a tough period on higher leverage can become painful. I’m thinking about going forward with the 1.5x version, but I should probably apply it during the next drawdown.

The simple formula for a trading edge

Alpha is the excess return one gets on top of the market beta (index return). It usually comes with additional commissions to the brokerage, fees for data and software, cost for educational services, seminars etc. In the real world, there are also taxes that the index chart doesn’t have. So considering all of this, it’s hard for most people to beat the market index not because they aren’t smart enough, but because of all the additional business costs that eat up the alpha they try to add by actively managing a portfolio. Brokerage companies and salesmen love it! Even if I have a tough period and the portfolio goes into a drawdown, my brokerage is still making money off of me. So the main formula for portfolio management goes as following:

Trading edge = alpha + beta – taxes – fees and commissions – other expenses

Even if having alpha on top of the market return (beta), it can still be difficult to beat the market due to taxes, fees and other expenses. You either have an alpha big enough or low expenses, or just invest in beta and forget about everything in this industry. If one pays for services and tools that don’t give any alpha, then it’s throwing away beta, resulting in underperformance. You can’t deny simple math. It’s part of thinking about capital efficiency.

Share this post

2 replies on “The market is understood backwards, but can only be traded forwards”

So, you are basically concluding/suggesting that for the most of us, index investing (going with the beta) is the best option?

I think that investing and trading are so personal that noone can suggest others anything in this field. My own take is that I don’t like index investing, but on the other hand it’s very hard to beat in the long run if one is still adding money to the portfolio and not regularly withdrawing out. Getting alpha is hard, it needs dedication and most of the public stuff out there will have people throwing away beta.